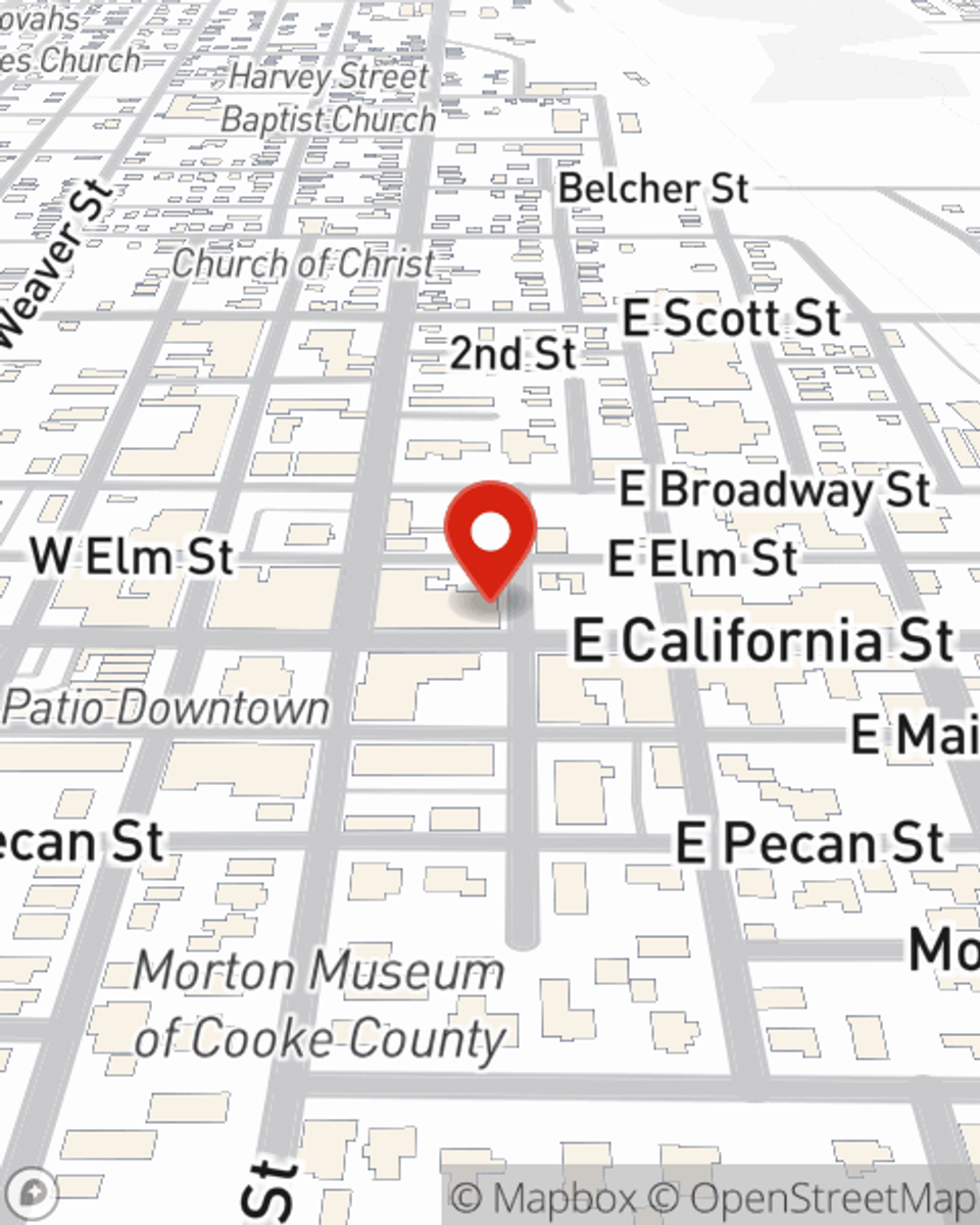

Homeowners Insurance in and around Gainesville

Gainesville, make sure your house has a strong foundation with coverage from State Farm.

Give your home an extra layer of protection with State Farm home insurance.

Would you like to create a personalized homeowners quote?

Welcome Home, With State Farm Insurance

Home is where laundry is continuous love resides, and you're protected with State Farm's homeowners insurance. It just makes sense.

Gainesville, make sure your house has a strong foundation with coverage from State Farm.

Give your home an extra layer of protection with State Farm home insurance.

Homeowners Insurance You Can Trust

Agent Jim Goldsworthy has got you, your home, and your belongings secured with State Farm's homeowners insurance. You can call or go online today to get a move on building a policy that fits your needs.

Your home is important, but unfortunately, the unforeseeable circumstance may occur. That's why you need State Farm's homeowners insurance. Plus, if you need some more air space, our bundle and save option could be right for you. Jim Goldsworthy can help you get the information you need!

Have More Questions About Homeowners Insurance?

Call Jim at (940) 665-7777 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Common rental scams and landlord frauds

Common rental scams and landlord frauds

Rental and landlord scams are more common than you think. Learn ways to tell if a rental is legitimate and how to avoid apartment scams.

Should you DIY your move or hire someone?

Should you DIY your move or hire someone?

Moves can vary in price — and effort. We walk you through your options, from DIY to full-service professional movers, and provide recommendations for when to opt for each.

Jim Goldsworthy

State Farm® Insurance AgentSimple Insights®

Common rental scams and landlord frauds

Common rental scams and landlord frauds

Rental and landlord scams are more common than you think. Learn ways to tell if a rental is legitimate and how to avoid apartment scams.

Should you DIY your move or hire someone?

Should you DIY your move or hire someone?

Moves can vary in price — and effort. We walk you through your options, from DIY to full-service professional movers, and provide recommendations for when to opt for each.